SEC is reaching international buyers and end users through its new YouTube channel at: https://www.youtube.com/channel/UCaA_XXfjf4PfZvW--6w8rrg. The channel features SEC and member videos including lumber grading tutorials and other educational and promotional videos.

Expanding Export Markets for U.S. Softwood Products

Helping industry organizations establish and grow sales around the world

|

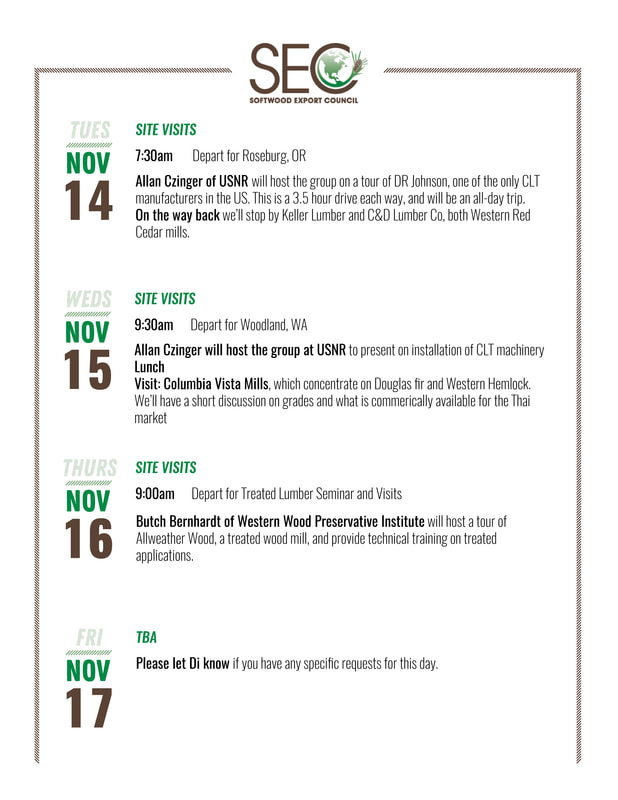

In the final months of 2017, SEC hosted two groups of incoming delegates from Mexico and Thailand. The Mexican representatives visited Seattle before attending the NAWLA Traders Market in Chicago, and shortly thereafter we hosted the Thai group in Portland for a comprehensive tour of the softwood industry in Oregon & Washington. While appealing to different markets, both of these missions focused on innovation at the mill and in construction, highlighting sustainability, efficiency, and the symbiotic relationship of these two properties. These tours are at the heart of SEC's mission: to build relationships through more personal outreach. Hosting delegates is a strategic way to get importers from different markets to begin thinking about American softwoods, first because of the connection we've built, and finally because of the quality of our wood and the examples we have illustrated by examining creative end-uses. In demonstrating how and why the U.S. consumes wood, we join others to our cause, as our sites speak for themselves: wood is transformed for visitors into an exciting material that brings light and warmth into corporate spaces, character into homes, and carries enormous long-term benefits for the health of our planet. To prepare these inbound missions, our itineraries are carefully crafted to exhibit a holistic system that allows a burgeoning market to understand the advantages of American softwoods, and what it would take to replicate our best-practices. Our itinerary for the Thais is a great example: it included tours of a forest, multiple mills, a CLT exhibition, and construction sites that exemplified the possibilities of mass timber, while also demonstrating the opportunities for efficiency in construction that wood can provide. Likewise, our Mexican delegates visited finished sites where mass timber meets sustainability in public and corporate spaces. The seminars we arrange are supplementary, offering an opportunity to delve deeper and ask questions about what the visiting groups have seen. This technical training privileges structural lumber and construction sectors: when you teach people how to build with wood, they buy wood. And, of course, we include networking opportunities for our members, and exposure to our industry. There are upcoming inbound missions planned for 2018 that will use these same systems-based tenets. A delegation from China in January will focus on mass timber engineering systems, while an incoming Pakistani group in July will focus on sourcing. Ensuring our programs meet the needs of the markets they're designed to inform is crucial, as these are countries in different stages of development. Pakistan is an early-market distribution area, while China has the infrastructure to handle mass timber and will be excited about the opportunities U.S. softwood can bring their growing skyline.

SEC’s board meeting this February took place in Mexico and included a joint meeting with Mexico’s National Association of Importers & Exporters of Forest Products (IMEXFOR). Mexico has been a market of growing potential for the last five years: while SEC has spent relatively little on promotions in this country, the exports to this market now exceed Japan, one of SEC’s most active programs. Organizing this conference in conjunction with our board meeting allowed members to network and share expertise with the Mexico industry; through our joint meeting SEC has been able to investigate long term opportunities for U.S. softwoods in lumber and value-added building materials, meanwhile developing relationships with importers as potential partners and promoters of U.S. softwoods. Beginning with an overview of Mexico’s major statistics delivered by Julio Maldanado of Mexico City’s Agricultural Trade Office, the meeting also included an overview of Mexico’s wood import market from Everado Martinez Salazar, and a look at the latest trends in Mexico’s academic sector. This collaboration with IMEXFOR was particularly eye-opening in detailing the international competition present in the Mexico market, as well as opportunities and obstacles for U.S. softwood products. Feedback from IMEXFOR members is included below: Mexico is the world’s 14th largest landmass, sharing a 1,860 mile border with the U.S. that contains 63 crossings. Each year, Mexico’s need for wood increases, with most of the lumber entering Mexico from the U.S. used for furniture manufacturing and packaging material. There are few examples of softwoods in construction, including OSB roofing supported by inexpensive steel beams. IMEXFOR’s representatives advised members to find a niche in order to introduce lumber to construction—perhaps low-income housing would be the best way to enter the structural market.

Continued engagement with IMEXFOR is crucial to maintaining our relationships, fostering greater collaboration, and creating more opportunities to do business within the Mexican market. More information on Mexico can be found through our membership-accessible Statistics & Reports downloads. |

Markets

All

|