The U.S. softwood industry has worked consistently for over two decades to introduce U.S. species to Chinese construction professionals and the efforts continue to pay off. Millions of dollars of U.S. softwoods are showcased in world-class architectural projects across the country – many of which were completed during trade tensions between the U.S. and China.

The Softwood Export Council, the Southern Forest Products Association, and APA-The Engineered Wood Association (known internationally as “American Softwoods”) have worked extensively with China’s Ministry of Construction to develop wood frame construction codes and technical manuals for architects and engineers. Trade missions and seminars introduced construction professionals to U.S. species and wood frame and hybrid construction design. As a result, China’s design community is increasingly turning to wood as a preferred building material.

Notable examples include:

Douglas-fir imported from the western U.S. is used extensively in a massive hotel and exhibition facility under construction in Nanjing. Slated for completion in 2022, the project uses thousands of cubic meters of U.S. Douglas-fir in glue-laminated beams for the building’s roof structure. The project is being touted by the local government as a prime example of green construction.

Douglas fir is also prominently featured in the main exhibit hall of the “Horticulture Exhibition of Jiangsu Province”, a 129,000 square foot concrete/wood hybrid structure that was completed in November 2019 (pictured to the right). The three-story building features soaring ceilings with exposed Douglas fir glulam posts and beams. The steeply pitched, angular roof was designed to evoke the shape of a resting bird.

The architect’s motivation for using Douglas fir for the project underscored the effectiveness of American Softwoods’ work in China. According to Wang Jianguo, Chief Designer for the project, "Modern wood frame construction is used in the exhibition hall, giving the hall an ambient light but with good thermal insulation.” The project, and the benefits of wood frame construction, received national press coverage.

Another design that utilizes the strength and beauty of Douglas fir to achieve a dramatic design with is the Chongqing Yunshan Art Gallery Resort, located at the base of the mountains of western China. The resort includes an exhibition hall, wedding chapel, and guest rooms and includes an A-frame roof, constructed of Douglas fir glulam beams and supported by glulam posts and to achieve a blend of traditional Chinese architecture and modern design.

U.S. Southern Pine is on display in the Luhu Resort Hotel and the Shanghai Poly Grand Theatre. Southern Yellow Pine was selected for outdoor walkways at Luhu Resort because it was well suited to withstand the humid, insect prone environment. The material also contributed to the nature-inspired design that was influenced by the region’s semi-tropical setting.

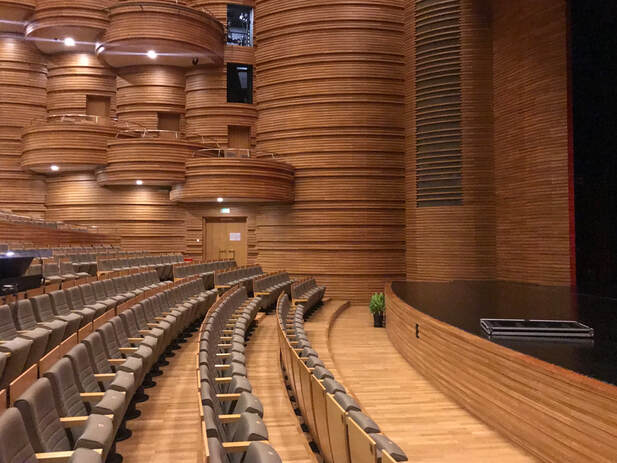

The selection of Southern Pine plywood as interior cladding for the Shanghai Poly Grand Theatre was a decision based on a desire for beauty and function. Designed by architect Tadao Ando and completed in 2014, the Shanghai Poly Grand Theatre hosts operas, concerts, and plays and was one of the first cultural buildings of this scale in the area. Together, the design and the woodwork create a hall that is acoustically tuned to provide the audience with an optimal concert experience.

Although these impressive projects are major steps in the right direction, work towards greater use of U.S. wood in China continues. The U.S. industry is surveying architects and engineers in China to better meet the needs of the local design community and adapt its communication and promotional strategy accordingly. Learn more about these activities at www.softwood.org and www.americansoftwoods.org

The Softwood Export Council, the Southern Forest Products Association, and APA-The Engineered Wood Association (known internationally as “American Softwoods”) have worked extensively with China’s Ministry of Construction to develop wood frame construction codes and technical manuals for architects and engineers. Trade missions and seminars introduced construction professionals to U.S. species and wood frame and hybrid construction design. As a result, China’s design community is increasingly turning to wood as a preferred building material.

Notable examples include:

Douglas-fir imported from the western U.S. is used extensively in a massive hotel and exhibition facility under construction in Nanjing. Slated for completion in 2022, the project uses thousands of cubic meters of U.S. Douglas-fir in glue-laminated beams for the building’s roof structure. The project is being touted by the local government as a prime example of green construction.

Douglas fir is also prominently featured in the main exhibit hall of the “Horticulture Exhibition of Jiangsu Province”, a 129,000 square foot concrete/wood hybrid structure that was completed in November 2019 (pictured to the right). The three-story building features soaring ceilings with exposed Douglas fir glulam posts and beams. The steeply pitched, angular roof was designed to evoke the shape of a resting bird.

The architect’s motivation for using Douglas fir for the project underscored the effectiveness of American Softwoods’ work in China. According to Wang Jianguo, Chief Designer for the project, "Modern wood frame construction is used in the exhibition hall, giving the hall an ambient light but with good thermal insulation.” The project, and the benefits of wood frame construction, received national press coverage.

Another design that utilizes the strength and beauty of Douglas fir to achieve a dramatic design with is the Chongqing Yunshan Art Gallery Resort, located at the base of the mountains of western China. The resort includes an exhibition hall, wedding chapel, and guest rooms and includes an A-frame roof, constructed of Douglas fir glulam beams and supported by glulam posts and to achieve a blend of traditional Chinese architecture and modern design.

U.S. Southern Pine is on display in the Luhu Resort Hotel and the Shanghai Poly Grand Theatre. Southern Yellow Pine was selected for outdoor walkways at Luhu Resort because it was well suited to withstand the humid, insect prone environment. The material also contributed to the nature-inspired design that was influenced by the region’s semi-tropical setting.

The selection of Southern Pine plywood as interior cladding for the Shanghai Poly Grand Theatre was a decision based on a desire for beauty and function. Designed by architect Tadao Ando and completed in 2014, the Shanghai Poly Grand Theatre hosts operas, concerts, and plays and was one of the first cultural buildings of this scale in the area. Together, the design and the woodwork create a hall that is acoustically tuned to provide the audience with an optimal concert experience.

Although these impressive projects are major steps in the right direction, work towards greater use of U.S. wood in China continues. The U.S. industry is surveying architects and engineers in China to better meet the needs of the local design community and adapt its communication and promotional strategy accordingly. Learn more about these activities at www.softwood.org and www.americansoftwoods.org