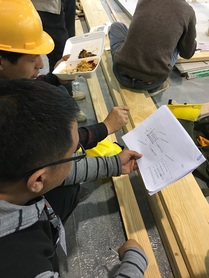

During the event, the group cooperated with the US Foreign Agricultural Service to conduct a seminar about the use of US lumber. The seminar attracted construction professionals and building material traders who attended to hear about wood products centering on the “Green Living” theme of the trade show. Speakers were:

- Criswell Davis – Designing and building with American hardwoods

- Rose Braden – Introduction to softwood species from the Western and Eastern United States

- Jerry Hingle – Introduction to Southern Pine lumber and preservative-treated lumber

- Xu Fang – Building with wood

The event was very well attended, gathering a “standing room only” audience of 84 attendees. Interest was high judging from the numerous questions that the presenters fielded, some of which were:

Bluestain – Echoing earlier discussions, attendees asked about addressing bluestain often found in imported softwoods.

Pricing – Attendees requested pricing of U.S. softwoods, a question that is often asked in new emerging markets. Speakers responded that there’s no easy answer as it depends on the species, grade, size, transport costs, etc. Nevertheless, research shows that U.S. softwoods are priced competitively in the market, particularly in light of rising prices of domestic rubberwood.

Termites – The audience appeared keenly interested in thwarting termite damage in wood, asking numerous questions on subterranean termites vs. Formosans (Formosans are a variety of subterraneans), types of wood preservatives, etc.

Follow up work to facilitate interactions between US softwood lumber suppliers and importers and manufacturers will be held in October 2020. Please see the SEC Events page for more information.